Top CRM Solutions Tailored for Accountants

** **CRM systems are not just for sales teams; they are crucial for accountants too. These platforms help manage client relationships, track interactions, and automate many routine tasks, freeing up time for more strategic activities.

**CRM systems are not just for sales teams; they are crucial for accountants too. These platforms help manage client relationships, track interactions, and automate many routine tasks, freeing up time for more strategic activities.

The Role of CRM in Modern Accounting

In the evolving landscape of accounting, CRM systems play a pivotal role in transforming how accountants manage their practices. By centralizing client data and streamlining communication, these systems enable accountants to focus on more value-added services. Furthermore, they support compliance and reduce the risk of errors by maintaining accurate records.

Bridging the Gap Between Accountants and Clients

A CRM system enhances the connection between accountants and their clients by facilitating seamless communication. With features like automated reminders and personalized outreach, accountants can ensure that clients feel valued and informed. This improved engagement can lead to higher client retention and satisfaction.

Technology Adoption in Accounting Firms

The adoption of CRM technology in accounting firms has been steadily increasing, driven by the need for greater efficiency and competitive advantage. As firms recognize the benefits of CRM systems, they are investing in technology to improve client service and operational efficiency. The shift towards digital tools is reshaping the accounting landscape and setting new benchmarks for client management.

Why Do Accountants Need CRM?

A CRM for accountants helps in organizing client information, tracking communications, and managing workflow efficiently. It can help tax professionals maintain a clear overview of client engagements, ensuring no details slip through the cracks. Additionally, CRM systems can foster better client relationships through personalized communication and timely follow-ups.

Enhancing Client Information Management

Efficient client information management is at the heart of CRM systems for accountants. These systems provide a unified platform to store and access client data, eliminating the need for disparate files and spreadsheets. By having all information in one place, accountants can quickly retrieve details and respond to client inquiries with greater accuracy.

Streamlining Communication and Follow-Ups

CRMs facilitate streamlined communication by automating follow-up processes and scheduling reminders. This ensures that no client interaction is missed and allows accountants to maintain consistent and timely communication. Automated follow-ups not only save time but also enhance client satisfaction by demonstrating a proactive approach.

Improving Workflow and Operational Efficiency

By automating routine tasks, CRMs improve workflow efficiency and reduce the burden of manual processes. Accountants can automate tasks like invoicing, reporting, and appointment scheduling, freeing up time for strategic activities. This increased efficiency enables accountants to focus on delivering high-quality services and expanding their client base.

Key Features of CRM for Accountants

When selecting a CRM system, tax professionals should look for features that address their specific needs. Here are some essential features to consider:

Client Management

A robust CRM should provide detailed client profiles, including contact information, interaction history, and any pertinent documents. This centralizes all client information, making it easily accessible and manageable.

Centralized Client Profiles

Centralized client profiles allow accountants to manage all client-related information in one location, reducing the time spent searching for details across multiple platforms. This feature enhances the ability to provide personalized service and quickly address client needs.

Interaction History Tracking

Tracking interaction history is crucial for understanding client behavior and preferences. A CRM that logs all communications, meetings, and transactions provides a comprehensive view of the client relationship, enabling accountants to tailor their services accordingly.

Document Management and Accessibility

The ability to store and access documents within the CRM is a significant advantage for accountants. This feature ensures that important documents are securely stored and easily retrievable, facilitating smoother client interactions and compliance with regulatory requirements.

Workflow Automation

Workflow automation is a significant time-saver for accountants. A CRM that automates routine tasks such as follow-up emails, appointment scheduling, and task reminders can increase efficiency and reduce human error.

Automating Routine Communications

Automating routine communications, such as follow-up emails and appointment confirmations, minimizes the administrative burden on accountants. This automation ensures consistent communication with clients, improving the overall client experience.

Scheduling and Task Management

CRMs with built-in scheduling and task management tools help accountants organize their workload efficiently. By automating these processes, accountants can focus on more critical tasks and reduce the risk of missing deadlines.

Error Reduction Through Automation

Automation reduces the likelihood of human error by ensuring that routine tasks are completed accurately and consistently. This reliability is especially important in accounting, where precision is paramount.

Document Management

Handling a variety of documents is a daily task for accountants. A CRM with document management capabilities allows for secure storage, easy retrieval, and seamless sharing of important documents.

Secure Document Storage

Secure document storage within a CRM provides peace of mind for accountants and their clients. These systems use encryption and access controls to protect sensitive information from unauthorized access.

Easy Document Retrieval

The ability to quickly retrieve documents is essential for efficient client service. CRMs with robust search and indexing features enable accountants to find and access documents without delay, enhancing productivity.

Seamless Document Sharing

Seamless document sharing capabilities within a CRM facilitate collaboration and communication with clients and colleagues. By allowing secure document exchange, accountants can streamline processes and improve client interactions.

Reporting and Analytics

A good CRM offers reporting tools to track performance metrics and analyze client interactions. This feature helps accountants make data-driven decisions and improve their service offerings.

Performance Metric Tracking

Tracking performance metrics through a CRM provides insights into the effectiveness of client interactions and overall business performance. Accountants can use this data to identify areas for improvement and make informed decisions.

Analyzing Client Interactions

Analyzing client interactions helps accountants understand client needs and preferences. CRMs that offer detailed analytics enable accountants to tailor their services and enhance client satisfaction.

Data-Driven Decision Making

Data-driven decision making is a key advantage of using a CRM. By leveraging analytics, accountants can develop strategies to improve client service, optimize operations, and drive business growth.

Top CRM Solutions for Accountants

Here are some of the best CRM solutions tailored specifically for accountants and tax professionals:

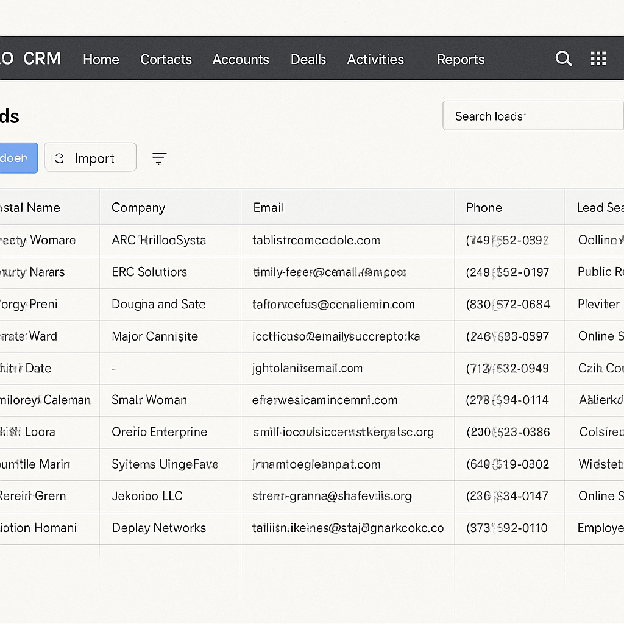

1. Zoho CRM

** **Zoho CRM is a versatile platform that offers a comprehensive suite of tools for accountants. It provides robust client management features, workflow automation, and detailed analytics. Zoho’s integration capabilities with various accounting software make it a popular choice for CPAs.

**Zoho CRM is a versatile platform that offers a comprehensive suite of tools for accountants. It provides robust client management features, workflow automation, and detailed analytics. Zoho’s integration capabilities with various accounting software make it a popular choice for CPAs.

Comprehensive Suite of Tools

Zoho CRM offers a wide range of tools designed to meet the diverse needs of accountants. From client management to advanced analytics, this platform provides everything necessary to streamline operations and enhance client service.

Integration Capabilities

The integration capabilities of Zoho CRM allow seamless connectivity with various accounting software, enhancing its functionality. This interoperability ensures a smooth workflow and reduces the need for manual data entry.

Customization and Affordability

Zoho CRM is highly customizable, allowing accountants to tailor the platform to their specific needs. Its affordability makes it an attractive option for firms of all sizes, providing excellent value for money.

- Pros: Highly customizable, affordable, and integrates well with other tools.

- Cons: Can have a steep learning curve for beginners.

2. QuickBooks CRM

QuickBooks CRM is designed to work seamlessly with QuickBooks accounting software, offering accountants a streamlined experience. This CRM focuses on client management and simplifies financial tasks, enhancing productivity.

Seamless Integration with QuickBooks

QuickBooks CRM’s seamless integration with QuickBooks accounting software provides a unified platform for managing financial tasks. This integration enhances productivity by reducing the need for duplicate data entry and streamlining processes.

Simplified Financial Task Management

The focus on simplifying financial tasks makes QuickBooks CRM an ideal choice for accountants. By automating routine financial processes, this CRM helps accountants save time and reduce errors.

User-Friendly Interface

The user-friendly interface of QuickBooks CRM makes it accessible to accountants of all experience levels. Its intuitive design ensures that users can quickly navigate the platform and maximize its benefits.

- Pros: Easy integration with QuickBooks, user-friendly interface.

- Cons: Limited features compared to other CRMs.

3. HubSpot CRM

HubSpot CRM is known for its user-friendly design and powerful features. It offers comprehensive tools for client management, marketing automation, and reporting. Its free version is an excellent option for small firms looking to start with CRM.

Powerful Features and Design

HubSpot CRM combines a user-friendly design with powerful features, making it an excellent choice for accountants. Its comprehensive tools support efficient client management and marketing automation.

Marketing Automation Capabilities

The marketing automation capabilities of HubSpot CRM enable accountants to manage client outreach effectively. By automating marketing tasks, accountants can maintain consistent communication and enhance client engagement.

Accessibility for Small Firms

The free version of HubSpot CRM provides small firms with access to essential CRM features without financial commitment. This accessibility allows small firms to experience the benefits of CRM technology and scale as needed.

- Pros: Free basic version, excellent integration options, intuitive design.

- Cons: Some advanced features require paid subscriptions.

4. Salesforce CRM

Salesforce is a leader in the CRM industry, offering a wide range of features suitable for accountants. Its platform supports extensive customization and automation, making it a powerful tool for managing client relationships.

Industry-Leading Features

Salesforce CRM offers a comprehensive set of features that set industry standards for CRM systems. Its robust platform supports extensive customization and automation, providing accountants with a powerful tool for client management.

Customization and Automation

The customization and automation capabilities of Salesforce CRM allow accountants to tailor the platform to their specific needs. This flexibility ensures that the CRM can adapt to the unique requirements of any accounting practice.

Scalability for Growing Firms

Salesforce CRM is designed to support firms of all sizes, making it an ideal choice for growing practices. Its scalability ensures that the platform can accommodate increased demand and evolving business needs.

- Pros: Highly customizable, strong automation capabilities.

- Cons: Can be expensive and complex for small firms.

5. Freshsales CRM

Freshsales offers a user-friendly interface with powerful features for client management and automation. It is well-suited for accountants who need an efficient way to track client interactions and organize tasks.

User-Friendly Interface and Features

Freshsales CRM combines a user-friendly interface with powerful features, making it accessible to accountants of all experience levels. Its design ensures that users can quickly navigate the platform and maximize its benefits.

Efficient Client Interaction Tracking

The efficient client interaction tracking capabilities of Freshsales CRM enhance the ability to manage and analyze client relationships. This feature supports informed decision-making and improved client service.

Affordable and Supportive

Freshsales CRM is an affordable option for accountants, providing excellent value for money. The platform also offers strong support, ensuring that users can resolve any issues quickly and effectively.

- Pros: Affordable, easy to use, excellent support.

- Cons: May lack some advanced features of other CRMs.

Implementing a CRM in Your Practice

Implementing a CRM system can transform your accounting practice. Here are some steps to ensure a smooth transition:

Assess Your Needs

Before choosing a CRM, evaluate your current processes and identify areas that need improvement. Determine what features are essential for your practice and what problems you need the CRM to solve.

Identifying Current Process Inefficiencies

Assessing your current processes involves identifying inefficiencies and areas for improvement. By understanding your practice’s pain points, you can determine which CRM features will provide the most significant benefits.

Defining Essential Features

Defining the essential features for your practice ensures that you select a CRM that meets your needs. Consider the specific challenges you face and the functionalities that will address them effectively.

Aligning CRM Goals with Business Objectives

Aligning your CRM goals with your overall business objectives ensures that the system supports your practice’s growth and success. Consider how the CRM can help you achieve your long-term goals and improve client service.

Research and Choose a CRM

Consider the CRMs discussed above and compare their features, pricing, and user reviews. Select a CRM that aligns with your practice’s needs and budget.

Comparing Features and Pricing

When researching CRMs, compare their features and pricing to determine which platform offers the best value for your practice. Consider both the short-term and long-term costs of implementing the CRM.

Evaluating User Reviews and Testimonials

User reviews and testimonials provide valuable insights into the real-world performance of CRM systems. Consider feedback from other accountants to gauge the platform’s effectiveness and ease of use.

Selecting the Right CRM for Your Practice

After thorough research, select a CRM that aligns with your practice’s needs and budget. Ensure that the platform offers the features you require and can scale with your business as it grows.

Train Your Team

A CRM is only as effective as the people using it. Provide thorough training for your team to ensure they understand how to use the CRM effectively. This will maximize the benefits and improve overall efficiency.

Developing a Training Plan

Developing a comprehensive training plan ensures that your team understands how to use the CRM effectively. Consider different learning styles and provide resources that cater to varied needs.

Encouraging Continuous Learning

Encouraging continuous learning helps your team stay updated on CRM features and best practices. Offer ongoing training opportunities and resources to ensure that users can maximize the platform’s benefits.

Measuring Training Effectiveness

Measuring the effectiveness of your training program helps identify areas for improvement. Gather feedback from your team and assess their proficiency with the CRM to ensure that they can use the system effectively.

Customize Your CRM

Take advantage of customization options to tailor the CRM to your practice’s specific needs. Set up workflows, templates, and reports that align with your processes.

Tailoring Workflows to Practice Needs

Customizing workflows within the CRM ensures that they align with your practice’s unique processes. This customization enhances efficiency and ensures that the system supports your specific needs.

Creating Custom Templates and Reports

Creating custom templates and reports allows you to streamline operations and improve data analysis. Tailor these resources to your practice’s requirements to enhance productivity and decision-making.

Leveraging CRM Customization for Growth

Leveraging CRM customization supports your practice’s growth by ensuring that the platform can adapt to changing needs. Regularly review and update customizations to align with evolving business objectives.

Monitor and Evaluate

Continuously monitor the CRM’s performance and gather feedback from your team. Make adjustments as needed to improve functionality and address any issues that arise.

Tracking CRM Performance Metrics

Tracking CRM performance metrics provides insights into the system’s effectiveness and areas for improvement. Regularly review these metrics to ensure that the CRM supports your practice’s objectives.

Gathering Team Feedback

Gathering feedback from your team helps identify any issues or challenges they face when using the CRM. Use this feedback to make necessary adjustments and improve the system’s usability.

Making Data-Driven Adjustments

Using data-driven insights to make adjustments ensures that your CRM remains effective and efficient. Regularly evaluate the system’s performance and make changes as needed to optimize its benefits.

Conclusion

** **by Andrijana Bozic (https://unsplash.com/@vesnikproleca)

**by Andrijana Bozic (https://unsplash.com/@vesnikproleca)

A CRM tailored for accountants can significantly enhance client management, streamline workflows, and boost productivity. By choosing the right CRM solution and implementing it effectively, accountants can improve their practice’s efficiency and client satisfaction. Whether you are a CPA, tax professional, or manage a small accounting firm, a CRM can be a valuable addition to your toolkit, helping you to stay organized and responsive in a competitive market.

The Long-Term Benefits of CRM Adoption

The long-term benefits of CRM adoption extend beyond immediate efficiency gains. By enhancing client relationships and streamlining operations, CRMs contribute to sustained business growth and success.

Staying Competitive in the Accounting Industry

In the competitive accounting industry, staying ahead requires leveraging technology to improve client service and operational efficiency. CRMs provide the tools needed to remain responsive and meet client expectations.

Embracing Technology for Future Success

Embracing CRM technology positions accountants for future success in an increasingly digital world. By integrating these systems into their practices, accountants can ensure that they remain competitive and capable of delivering exceptional client service.